Generation Z (Gen Z) is the portion of the population born between the mid-1990s and early 2010s which puts the age range from 10 - 25 years old. Let’s start by saying that this generation is widely considered to be more concerned about both professional and financial stability and less likely to be risk takers. These young consumers want what’s relevant now and won’t pay any mind to products that “don’t matter”. Specifically, this includes a draw to new age technologies such as smartphones, tablets, and laptops instead of traditional resources like physical books. Most importantly, these young consumers like to shop quickly and easily.

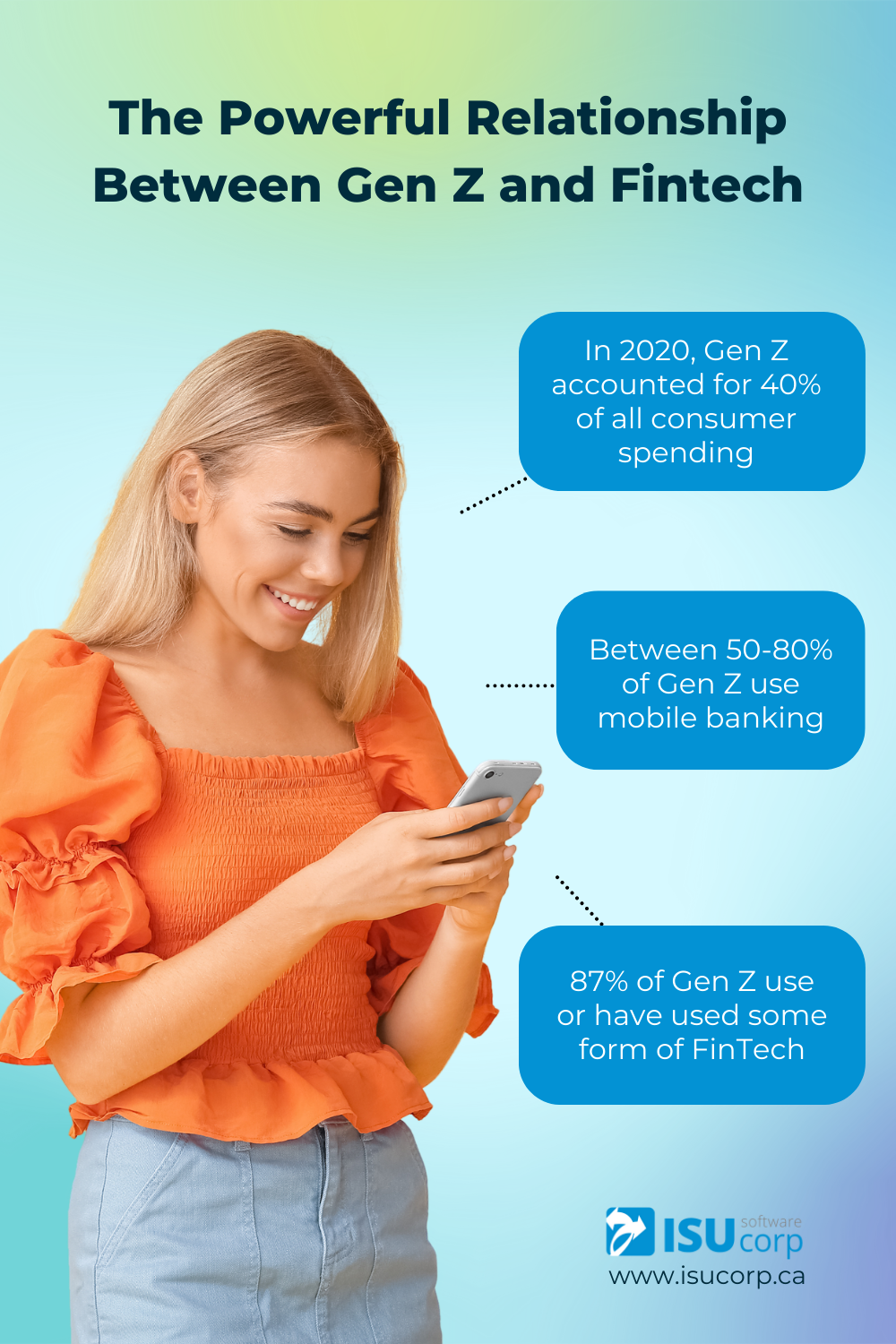

For FinTech companies, this screams opportunity. To put it further into perspective, consider these statistics:

In 2020, Gen Z accounted for 40% of all consumer spending

34% would rather invest in cryptocurrency than a pension

87% of Gen Z use or have used some form of FinTech

95% own a smartphone, 83% own a laptop, 78% own a gaming console, and 30% use their smartphone after midnight

Between 50-80% of Gen Z use mobile banking

We can see how invested this consumer group is in the products that have been in circulation thus far. Bear in mind that there are about 10,800 FinTech companies in North America alone. Of those, how many can you name off the top of your head? The market is highly competitive, especially for this consumer age range who have grown up with technology and are highly accustomed to day-to-day living with mobile banking and services of its nature. This creates both challenges and opportunities for FinTech companies who are anxious to get their product in front of the younger demographic.

The first point to note is that Gen Z will not be impressed by convenience or ease in the way millennials embraced services such as Robinhood or Venmo. This is a consumer group that wants personalization and not services that are mass-user-oriented. Of course, FinTech companies know this and have implemented features such as real-time data collection to create offers or users being able to compare their spending habits to that of their peers. The direction these applications are going in is ideal to continue to draw in young users who will use these services for a lifetime. However, to sustain that trajectory, there needs to be contingency planning.

It’s important to understand that Gen Z is not without their concerns, specifically when it comes to the climate, cost of living, and overall social consciousness. These consumers are very observant, especially in the tech space which has become a sizzling hub for marketing. The marketing approach taken by FinTech companies is creative for this demographic since it is aimed to address these concerns with personalized service. Again, being able to see and keep track of spending using digital metrics is a great example of something that would make a consumer feel comfortable using the service.

When it comes to the feasible aspects that companies should look to implement in their approach, here are three specific factors that are fueling the push of Gen Z to FinTech:

Trepidation around credit card debt: Studies found that only around 17% of Gen Z uses a credit card as their preferred payment method. This is surprising when compared to the usage rate of baby boomers (47%) and millennials (46%).

There are many reasons that this can be attributed to, such as seeing generations before them suffer from debt or the simple fact that young adults don’t have as easy access to credit. This has caused consumers to lean towards services like buy-now-pay-later which almost half of Gen Z will have used by the end of 2021.

Being able to connect with brands: Going back to the statement that this generation is socially conscious, they will look for that in the brands they trust. For example, FinTech company Stripe supports building technology for carbon removal. A big concern of Gen Z is climate change and building a sustainable infrastructure. By Stripe actively funding carbon removal, they are marketing themselves as more than just a financial service that is likely to attract the young demographic.

This is just one example of many as companies like Daylight, Aspiration, TreeCard, and many more are making the support of social issues a minimum standard for FinTech companies.

Community: Beyond the knowledge that their money is going towards something good for themselves or a given cause, young consumers want social interaction with their finances. When we look at things like “finfluencers”, crypto trading, or meme stocks, it’s clear that investing and financial education have built a community around themselves that Gen Z has embraced.

Charley Ma, General Manager at a New York City FinTech company called Alloy, made this statement regarding the company's relationship with Gen Z: "Nowadays, if you're a fintech company, you're wondering how to build interesting communities and get people to engage, respond, and interact with one another". Ma then states, "This is the new method of acquiring the next generation. I believe the features you must develop must be much more community-driven”.

Overseas embracement

The appeal of FinTech is not simply due to its virtual nature or modernity, rather its inclusivity and ease of use make it much bigger than that. When younger generations get their hands on new technology, they are likely to have a strong influence. India, for example, is home to one of the fastest growing FinTech markets bringing in $9 billion worth of investments in just the last 5 years. A recent trend that is just beginning in the country is gearing financial services specifically towards young adults and children. Many companies taking this approach have even partnered up with financial sharks such as Mastercard and Visa. India recognizes the market influence that younger generations possess and is now focusing its efforts to enhance that and take advantage of the demand.

Another country to look at is the United Kingdom which accounts for 11% of FinTech usage globally. In addition to that, more than 50% of those aged 16-24 in the country manage their money online. Of the 67 million that live in the country, there is an estimated 6.8 million within this age range which would make them account for around 10% of the population. When it comes to the United Kingdom’s economy, experts estimate that FinTech services contribute more than $13 billion and nearly 80,000 jobs. Young adults are estimated to contribute almost $2 billion to that, which in comparison may seem small, but don’t forget the influence this age group has on others.

The Takeaway

FinTech today has been designed based on the consumer demands that have prevailed in recent years, most notably since 2020 when the digital shift dramatically took over. It is made for users to navigate today’s complex financial landscapes. This is especially important when you consider that people don’t learn today like they did 20 or even 10 years ago.

Technology is the motivator for consumer usage and a streamlined method to interact and connect with consumers of any industry. FinTech businesses educating and involving the youth is a perfect way to make this technology (and your business) spread in all directions.

Written By Ben Brown

—

ISU Corp is an award winning software development company, with over 17 years of experience in multiple industries, providing cost effective custom software development, technology management, and IT outsourcing.

Our unique owners mindset reduces development costs and fast-tracks timelines. We help craft the specifications of your project based on your company's needs, to produce the best ROI. Find out why startups, all the way to fortune 500 companies like General Electric, Heinz, and many others have trusted us with their projects. Contact us here.