When you hear the term “coding,” you likely correlate it to an image of a programmer with headphones on in a dark room typing their fingers to the bone. To someone who isn’t familiar with the process, this may make coding seem like a robotic task consisting of nothing but numbers and letters. There’s a lot more to it than typing colourful lines on a black screen; the process itself is not for the fainthearted. Everyone interested in technology should at least have an understanding of coding, especially as society moves to a dominantly digital consumer landscape.

Coding in its most basic form can be defined as people communicating with and teaching computers how to function. When a developer goes into the system, they use code to instruct what actions the computer and other relevant hardware must perform. The apps, websites, and technology you use daily are brought to life through coding languages and frameworks. As technology becomes more relevant in people's everyday lives, the need for programmers grows.

Today, over 50% of jobs require skills in technology which has placed coding in high demand among those skills. We expect that number to reach nearly 80% in the next decade. This will trigger the vast majority of businesses to rethink their digital landscape and search for talent that is keeping up with/exceeding the demands of today.

So now that we’ve established what coding is, let's go into the specifics of what it takes to adopt the practice as a complete beginner:

Mindset

Coding is a problem-solving task that not only challenges but requires you to use critical and logical thinking. You have to see problems from a different perspective and then break that problem down into digestible tasks (Examples: Make a flowchart or divide it into sub-problems). In forming those tasks, the programmer is observing the situation and uses their knowledge of languages and frameworks to find a solution for each.

The code you're writing is meant to serve a purpose, this purpose needs to be in the front of your mind the whole time so you understand not only what you're doing but why you’re doing it. This will mean keeping a calm and collected attitude as you navigate the programming process. Essentially, coders need to understand that every problem has a solution and they have to do whatever it takes to find it.

Learn one language

To understand coding, it will be useful to master one coding language to the best of your ability. Some examples would typically be Java, Python, C, or Ruby as your best starting points. Aside from being among the most commonly used, they are easy to learn. Once you know one language, there will be carry-over concepts and knowledge that will make it easy to learn others. Additionally, it’s best to have one language that you’re more proficient with as your go-to since you’ll likely use it often.

Coding doesn’t require you to be a genius computer scientist. If you are a serial problem-solver, then you can learn the rest. One tool that will be a great resource is Harvard University’s free introductory to computer science course (CS50) that all first-year computer science students take. In this course, they teach you the basics of coding such as Algorithms, Data Structures, CSS, Python, JavaScript, and more. As you learn the fundamentals, you’ll move to execution, leading us to the next point.

Identify the purpose of your coding

When you build an understanding of coding principles and feel ready to put them into action, the next step is identifying your “why”. What needs are your solutions going to fill? We use coding to find ways of bringing concepts to life. Who in the 1970s would’ve thought you could send a text or FaceTime someone? These big changes in technology start with small advancements which will be a beginner's best friend.

Start coding something small such as crafting a simple message like “what is your name?” There are numerous methods to do even this specific task such as reverse alphabet letter correlation, manipulating the orientation of letters, or even using symbols to represent letters.

When one has built a solid understanding of software methodology and embraced a coder's mindset, one will see these simple tasks in different ways. It starts with an idea that becomes a vision. Essentially, when coding, you want to identify and try to solve your problem before you begin using algorithms. Seeing the solution and having it clear in your mind will stick with you as you find ways to fill in the gaps.

Get your hands dirty

Branching off of the last point, no experience will compare to what a great team can teach you. The coding community is very welcoming and will not refrain from sharing their knowledge and advice with a beginner. As you network within the settings where you are learning, find out if there are hackathons you can participate in. A hackathon is a big coding project crammed typically into a 24-hour window. Beginner-friendly hackathon events use basic coding languages which would be a great learning experience.

In addition to building a network and becoming active as a developer, it will be helpful to look into pair coding. This concept is rather self-explanatory as it is two programmers at one computer. There is the old saying “two minds are better than one” which is relevant in software development teams and why they use pair programming as an agile technique. But in a strictly learning-oriented manner, you will learn more from others than from tutorials or books.

Challenges to expect

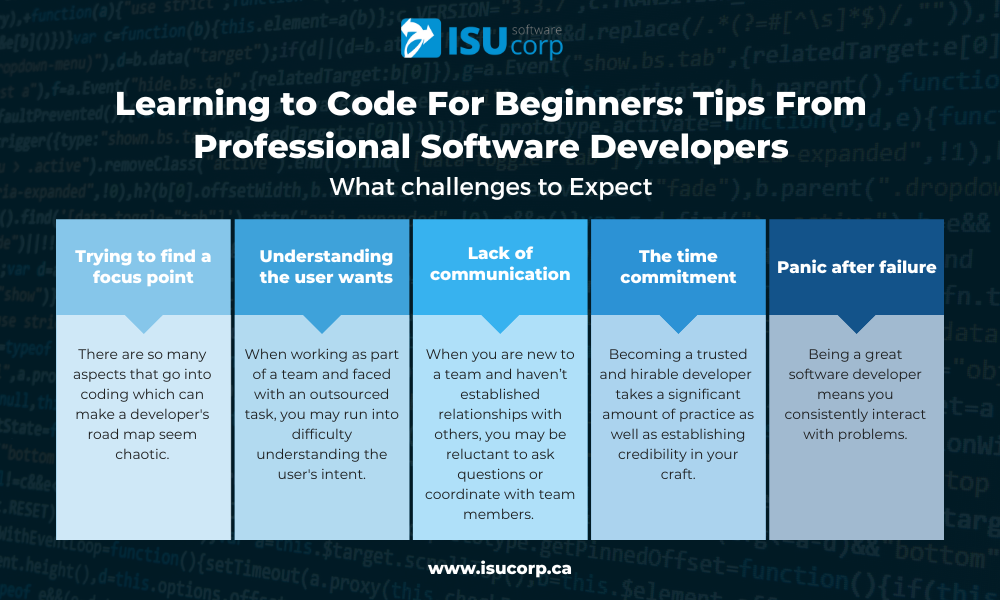

Now, while this section has depicted learning to code as a bed of roses, there are several challenges you can expect to encounter on your journey. In this section, we’ve outlined 5 key areas to look out for:

Not knowing what to focus on: There are so many aspects that go into coding which can make a developer's road map seem chaotic. As a beginner, this can be overwhelming and, in some cases, discouraging. However, a key characteristic of a good programmer is acknowledging and accepting that there is a lot you have to do to succeed.

Can’t understand what the user wants: When working as part of a team and faced with an outsourced task, you may run into difficulty understanding the user's intent. Programmers specifically run into this issue since they are not typically the ones sitting down with the client. Project managers make it less stressful to update software with scrum/agile approaches. However, this can only get you so far as a programmer when there is minimal interaction with the end user.

Lack of communication: When you’re newly working as part of a team and haven’t established relationships with others, you may be reluctant to ask questions or coordinate with team members. When working in IT, this can be a significant downfall since communication needs to be a consistent force within the team.

The time it takes: Becoming a developer that someone would want to hire (whether as part of a team or to handle an outsourced project) takes a significant amount of practice as well as establishing credibility in your craft. Everyone wants the shortcut, but just like anything worthwhile, coding takes time. You can’t learn these concepts in a week. Beginners need to understand the information and see it in action while acknowledging that there will be failures in the process.

Panic after failure: Being a great software developer means you consistently interact with problems. As you implement your attempt to solve these problems, you will not have a 100% success rate, which means things will go wrong. Finding out what went wrong is called “debugging” which is a process that scans for errors to determine their cause. Though sometimes it can be hard to admit mistakes, having this form of debriefing will make you better. Instead of letting emotions get in the way, finding the source of what went wrong and learning from that will be much more valuable.

The Takeaway

At the root of all these challenges and the learning processes remain the focal point of having the will to not only succeed but use technology to create an experience. Google wouldn’t be the platform we utilize every day without its codebase, and even that started out as a concept. If you take your time to learn the fundamentals, you will have this as a competitive advantage when working with technology.

Written By Ben Brown

—

ISU Corp is an award winning software development company, with over 17 years of experience in multiple industries, providing cost effective custom software development, technology management, and IT outsourcing.

Our unique owners mindset reduces development costs and fast-tracks timelines. We help craft the specifications of your project based on your company's needs, to produce the best ROI. Find out why startups, all the way to fortune 500 companies like General Electric, Heinz, and many others have trusted us with their projects. Contact us here.